Audit finds clean records, procedures, full compliance

By Ally Lanasa, Staff Writer

(Dec. 17, 2020) The town of Berlin’s financial record keeping is clear and clean, the town’s auditors from PKS & Company reported during a virtual Town Council meeting Monday night. Still, said PKS partner Michael Kleger and manager Leslie Michalik, work remains to be done on the town’s fund balance and on the separate sewer utility fund.

Leslie Michalik

The report on FY20 showed that internal controls are what they should be, and that there were no instances of noncompliance with Government Auditing Standards.

Another positive note in the audit is that Berlin government took in about $1 million more than it spent in FY20, with revenues were $6.8 million versus expenditures of $5.8.

The town’s general fund is divided into five smaller sections: nonspendable fund balance, restricted fund balance, committed fund balance, assigned fund balance and unassigned fund balance.

The FY20 nonspendable fund balance was nearly $3.4 million, restricted fund balance was $994,629, assigned fund balance was $791,005 and unassigned fund balance was $1 million with a total fund balance of $6 million.

“The nonspendable portion of that is $3,375,000 and that includes the amounts that are due from the sewer fund mostly and a little bit from the stormwater fund that are not available to pay the current year expenditures,” Michalik said. “After June 30, the mayor and council approved a transfer that’s going to cut that number in half, which is going to reduce it to approximately $1.7 million.”

The total unrestricted funds (assigned and unassigned) are $1.8 million, which represents 3.75 months of operating expenditures.

CHART COURTESY PKS & COMPANY

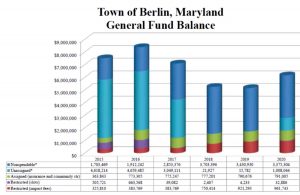

Representatives from PKS & Company presented a six-year comparison of Berlin’s general fund balance, which showed that the general fund balance was at its highest in 2016.

“Three-and-a-quarter months is your cushion or your buffer for future unanticipated needs,” Michalik said.

According to a chart of the general fund balance over the past six years, the general fund balance was at its highest in 2016.

“I know last year we recommended, and we repeated it this year, that the town develop a fund balance policy, and I know that some work has been done on it,” Michalik said. “But the policy would set the level at which the unrestricted balance should be maintained for budgetary purposes. The Government Finance Officers Association recommends no less than 60 days, which in Berlin’s case would be about $950,000. However, most towns need a cushion or a buffer higher than 60 days depending on their individual circumstances.”

She added that the town may want to include a buffer for any future storm damages it might have to cover.

“Sixty days is probably less than ideal for you,” Michalik said.

She then presented the general fund revenues by source for FY19 and FY20. For FY20, the total revenues were roughly $6.8 million, with 59 percent coming from property taxes, 16 percent from intergovernmental, or grant, revenues and 12 percent from service charges from the enterprise funds.

Of the $5.8 million total expenditures for the FY20 general fund, the biggest costs were public safety, general government and the public works department.

“If we compare expenditures this year to last year, expenditures decreased $900,000 or 13 percent, and they basically decreased in all categories due to budget cuts and also some of the covid limitations and canceled events also caused some decreases,” Michalik said.

The enterprise funds, which are separate from the general fund, are like separate accounts maintained by separate revenue-generating businesses, or enterprises. They are the electric fund, the water fund, the sewer fund and the stormwater fund.

“The electric fund had an operating loss of $144,000 this year compared to an operating income last year of $349,000,” Michalik said.

The interest expense of the electric fund was $155,061.

Michalik added that the fund had almost $1.8 million of insurance proceeds for replacement of the No. 2 generator.

She then showed a three-year trend of decreases in revenue in the electric fund.

As for the water fund, it had an operating loss of $127,494 during FY20, down from a loss of $202,048 in FY19.

“There was an increase in service charges of $53,000 or 8 percent due to an increase in the rates,” Michalik said.

Water fund expenditures decreased from the prior year by about $19,00, she added.

“Then, special connections fees went way down. They were $340,000 in 2019 down to $65,000 in 2020,” Michalik said. “So, the net position in the water fund actually decreased by $60,000 for the year.”

The sewer fund had an operating loss of $140,000, compared to an operating loss of $930,000 in 2019.

“Services charges increased $540,000 or 3 percent due to the increase in rates,” Michalik said.

“That’s a pretty significant improvement in the sewer fund from the prior year due to increasing your rates and really cutting your budget in expenses, but I don’t think you can relax,” Michalik said. “The work is not done. Going forward, you really need to continue to monitor the sewer fund. You need to continue monitoring your rates to make sure that they’re set at a high enough level to cover not only your operating expenses, but your capital expenses and your debt service costs.

“The Fiscal Year 20 budget pretty much had no capital expenses included in it, and so you can’t continue that going forward,” Michalik continued “At some point, you’re going to have to deal with some of the capital expenses, and then earlier we talked about the amount the sewer fund owes the general fund is going to be cut in half based on a transfer the mayor and council approved, so you have to watch that and be wary [the revenue-expense problem] doesn’t start creeping up and then in a couple years, you’re in the same position that you were before.”

The stormwater fund had an operating loss of $74,000 compared to an operating loss of nearly $99,000 the prior year.

“[It] had some capital grants of $71,000 for a decrease in net position of $3,430,” Michalik said.

The total net position of the enterprise funds for FY20 was $23 million as of June 30. The electric fund had a total net position of $4.4 million, the water fund had a total net position of $3.1 million, the sewer fund had a total net position of $12.9 million and the stormwater fund had a total net position of $2.4 million.

“In the enterprise funds, you want to look at working capital, and working capital is defined as ‘current assets less current liabilities,’” Michalik said. “Again, that’s your buffer for meeting your future obligations, so it’s important to maintain it at an adequate level. The Government Finance Officers Association recommends a target of no less than 45 days.”

The number of days of working capital in the electric fund was 225 days, in the water fund was 563 days and in the stormwater fund was 33 days.

“However, the sewer fund has a negative working capital, which means that it might not be able to pay its debts because it’s current liabilities exceed its current assets,” Michalik said. Mayor Zackery Tyndall asked the accountants how to go about establishing a reserve account.

“Do we do that in the form of an assigned or committed fund balance, so then that’s under more of a lock and key and requires council action for those monies to be moved?” he asked.

Michalik replied that the town could commit the fund through a resolution.

“If you have a committed fund balance, in order to reverse it, you would have to pass another resolution,” she said. “In order to reverse an assigned fund balance, you just have to make a decision to reverse it. Like, you’ve got money … assigned for the community center, but any point in time, you can say, ‘We’re not doing the community center. We’re going to unassign that.’ And you don’t have to pass a resolution or an ordinance to do that. It’s just a decision.”

Kleger and Tyndall agreed that the reserve account should be established initially as an assigned fund.

Michael Kleger

Tyndall also asked the accountants if other municipalities have capital reserve accounts.

“In general terms, they do have enough to cover their operating expenses, but when it comes to the longer- term capital projects, there’s typically not reserve funds for those,” Kleger said.

Before the audit presentation concluded, Councilman Jay Knerr asked if the town receives a grant to demolish the old Tyson Plant at Heron Park in town or wants to sell it, can the lease agreement for the property with Bryan Brushmiller, which is until 2023, be canceled.

“There is a 90-day kickout and there is language in there for him to have first right of refusal to purchase that property,” said Town Administrator Jeff Fleetwood.

Town Attorney David Gaskill added that it is at market value.

Lastly, Tyndall echoed the need to invest in aging infrastructure in the town during the upcoming fiscal years.

Kleger said to finance such improvements the town should consider grants available at the time of projects.